With issues like depressed values due to the pandemic, estate tax exemption levels, looming political decisions and historically low interest rates for ownership transitions, now may be an opportune time to transition ownership. Transferring closely held stock at depressed valuations may minimize gift or estate taxes and help preserve legacy. The following are four important reasons to consider 2020 estate planning immediately.

Depressed values, in general, due to the pandemic

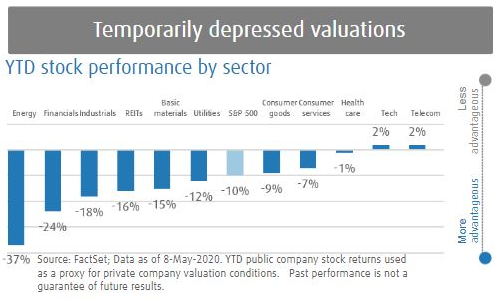

Since the mid-February onset of COVID-19, valuation experts claim that privately held company values are down 10-20% or more, on average, across all industries due to lower cash flow, higher risk (environmental/external and operational/internal), and lower expected growth.

Specifically, COVID-19 impacts all areas of the process which derives a company’s value, including:

- Valuation approaches:

- Asset approach: A methodology such as adjusted book value may become paramount at least as a floor value.

- Income approach: Discounted normalized future cash flow as reflected by management projections may be the best methodology.

- Market approach:

- Adjust market multiples downward generally but may adjust upward for essential and/or pandemic-resistant industries.

- Consider a new base of earnings before interest, taxes, depreciation, amortization, and coronavirus (EBITDAC), which attempts to normalize out the impact of the coronavirus pandemic.

- COVID-19 legislative benefits and the impact on value.

- Negative adjustments to value, such as discounts for lack of marketability, may be higher because interests in closely held companies may be even more illiquid and less saleable during this pandemic.

The estate tax exemption dropping back to $5 million or less from the 2020 level of $11.58 million on Jan. 1, 2026 or earlier

Under current law, the estate tax exemption is set to expire at the end of 2025. When the 2017 Tax Cuts and Jobs Act sunsets, estate tax exemption amounts will be reduced to $5 million for individuals or $10 million for a married couple, indexed for inflation.

Impending uncertain impact of upcoming election results on estate planning

Today’s record-high estate tax exemption amounts of $11.58 million per taxpayer are set to expire and more than halve at the end of 2025. Furthermore, estates in excess of the exclusion are currently taxed at 40%. The estate tax exemption may decrease sooner, along with tax rate changes. President-elect Joe Biden has proposed an estate tax exemption decrease of historical norms, which would dramatically increase the number of taxpayers subject to estate tax.

Biden has also proposed repealing stepped-up basis at death on bequests for which business valuations are also performed if the bequest is of a business interest. Currently, an individual may hold an asset for multiple years, during which the asset typically appreciates in value. When that individual dies and passes an asset to an heir, the basis (original investment in the asset) is stepped-up to the date-of-death or alternate valuation date market value. If the heir chooses to immediately sell the inherited asset, he/she can do so with minimal to no capital gains tax. Elimination of stepped-up basis will result in increased capital gains taxes for beneficiaries.

Taxpayers with net assets in excess of $3.5 million to $5 million of historical estate tax exemptions will want to consider 2020 estate planning to reduce their overall taxable estates. According to anti-clawback regulations published by the IRS, gifts made using today’s high exemption amount of $11.58 million are protected from future tax when the exemption amounts are reduced. In other words, use it or lose it.

Historically low interest rates for notes related to ownership transition

The IRS has announced historically low interest rates – ranging from .14% to 1% depending on term – to be used in connection with lifetime transfers of wealth. Current depressed values create a unique short-term opportunity to transfer wealth by using tools such as Grantor Retained Annuity Trusts, installment sales or intrafamily loans. Consider making these mechanisms part of your estate plan.